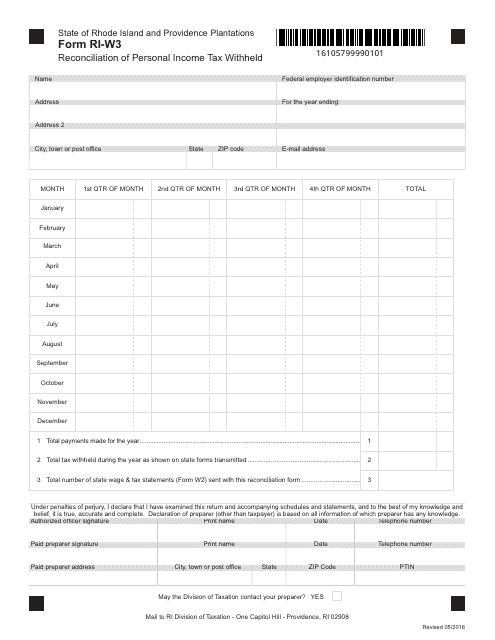

rhode island income tax withholding

South Carolina has a state income tax that ranges between 0 and 7 which is administered by the South Carolina Department of RevenueTaxFormFinder provides printable PDF copies of 69 current South Carolina income tax forms. You can try it free for 30 days with no obligation and no credt card needed.

State W 4 Form Detailed Withholding Forms By State Chart

Tax Obligations A Lottery prize is considered income and a taxable event when claimed or received.

. The Rhode Island Lottery is required to withhold State. A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island income of every individual estate and trust. The Rhode Island tax is based on federal adjusted gross income subject to modification.

The current tax forms and tables. Calculate your state income tax step by step 6. A Form W-2G is generated for all prizes of six hundred dollars 60000 and greater.

You can also find step by step guide on. The Division of Taxation has posted on its website the booklet of income tax withholding tables for tax year 20 22. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

If you want to automate payroll tax calculations you can download in-house ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically. The Rhode Island Lottery reports all prizes of six hundred dollars 60000 and greater to the Internal Revenue Service IRS. Employers use the tables to calculate how much to withhold from an employees pay for Rhode Island personal income tax purposes.

The booklet also includes a copy of the 202 version of Form RI W2 -4 Employees.

Federal Income Tax Deadline In 2022 Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

Income Tax Calculator 2021 2022 Estimate Return Refund

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

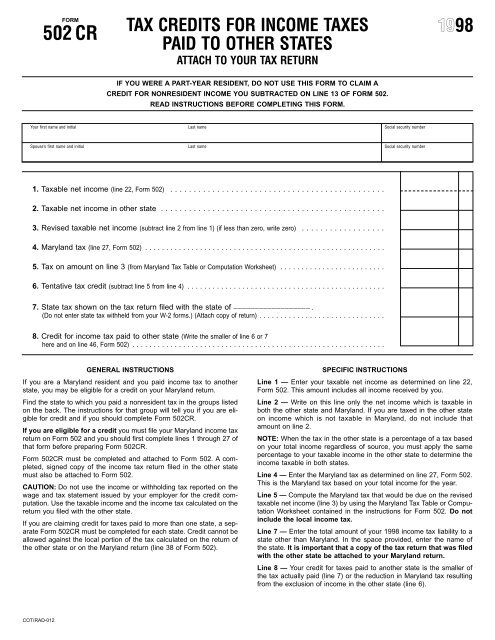

Tax Credits For Income Taxes Paid To Other States

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

What Are The State Income Tax Rates For California Quora

State Of Rhode Island Division Of Taxation Division Rhode Island Government

What Are Salary Taxes For Software Engineers In The Usa Quora

What Is Local Income Tax Types States With Local Income Tax More

State Corporate Income Tax Rates And Brackets Tax Foundation

State Income Tax Rates And Brackets 2022 Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Indiana Income Tax Rate And Brackets 2019

What Are Salary Taxes For Software Engineers In The Usa Quora

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)